Understanding Forex Trading: A Comprehensive Guide

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the foreign exchange market. This market is one of the largest and most liquid financial markets in the world, with billions of dollars traded daily. Traders aim to profit from fluctuations in currency values, but successful trading requires knowledge, strategy, and risk management. You can explore more about Forex trading on what is trading forex fx-trading-uz.com. In this article, we will delve into the basics of Forex trading, the mechanisms that govern it, the advantages it offers, and tips for anyone looking to start in this exciting market.

What is Forex Trading?

Forex trading involves the exchange of one currency for another in a decentralized market known as the Forex market or FX market. It operates 24 hours a day, five days a week, allowing traders from different time zones to engage in transactions at their convenience.

The primary goal of Forex trading is to exchange one currency for another at an agreed price in the hope of making a profit. For example, if a trader believes that the Euro (EUR) will strengthen against the US Dollar (USD), they might buy Euros with US dollars. If the Euro appreciates, the trader can later sell their Euros for a higher price in USD, thus making a profit.

The Mechanics of Forex Trading

The Forex market operates on a network of banks, brokers, and institutions. Trades happen over-the-counter (OTC), meaning there is no centralized exchange. Instead, trades are executed electronically via a computer network. Here are the key components:

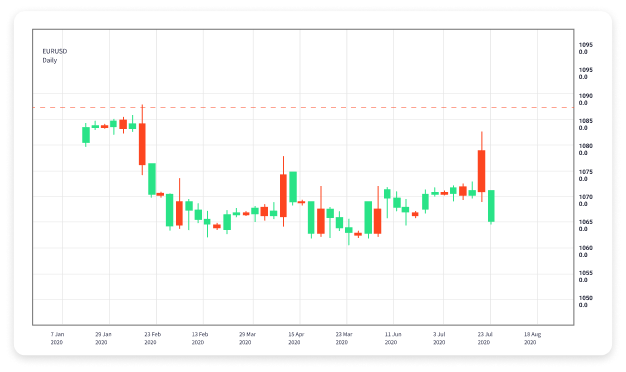

Currency Pairs

Currencies are traded in pairs, such as EUR/USD or USD/JPY. The first currency in the pair (the base currency) is the one you are buying or selling, while the second currency (the quote currency) is what you are using to make the trade. For instance, if the EUR/USD exchange rate is 1.20, it means 1 Euro can be exchanged for 1.20 US Dollars.

Bid and Ask Price

Every currency pair has a bid and an ask price. The bid price is the amount a trader can sell the base currency for, while the ask price is the amount needed to buy the base currency. The difference between the two prices is known as the spread and is essentially the broker’s fee for facilitating the trade.

Leverage

Leverage is a key feature in Forex trading, allowing traders to control larger positions with a smaller amount of capital. For example, with a leverage ratio of 100:1, a trader can control $100,000 with just $1,000. While leverage can amplify profits, it also increases the risk of significant losses, making risk management critical.

Advantages of Forex Trading

Forex trading offers several advantages that attract both novice and experienced traders:

High Liquidity

Given its massive size, the Forex market has high liquidity, meaning that traders can easily buy and sell currencies without significantly affecting their price. This results in tighter spreads and lower transaction costs.

24-Hour Market

The Forex market operates around the clock, allowing traders from different parts of the world to participate at any time. This flexibility makes it a convenient option for those looking to trade alongside other commitments.

Accessibility

With the advent of online trading platforms, Forex trading has become accessible to individual traders. Many brokers offer demo accounts, allowing newcomers to practice trading strategies without risking real money.

Variety of Trading Options

Forex trading provides a wide range of pairs to trade, enabling traders to diversify their strategies. Major pairs, minors, exotics, and cryptocurrencies all present different opportunities and risks.

Getting Started with Forex Trading

For those interested in entering the Forex market, here are some essential steps:

1. Educate Yourself

Understanding the fundamentals of the forex market is crucial. Traders should familiarize themselves with market principles, technical and fundamental analysis, and trading strategies.

2. Choose a Reliable Broker

Selecting a trustworthy broker is critical for successful trading. Look for brokers that are regulated and offer a user-friendly trading platform, competitive spreads, and strong customer service.

3. Practice with a Demo Account

Before risking real money, traders can practice their strategies using demo accounts. This allows them to gain experience and build confidence without financial risk.

4. Develop a Trading Plan

A trading plan should outline the trader’s goals, risk tolerance, and strategies. It will serve as a guide and help maintain discipline during trading.

5. Start Small

When transitioning to live trading, start with a smaller amount of capital to manage risk effectively. Gradually increase exposure as you gain experience and confidence.

Conclusion

Forex trading can be an exciting and potentially lucrative endeavor for individuals who take the time to understand the market and develop effective strategies. By grasping the fundamentals, leveraging the advantages of the Forex market, and practicing sound risk management, traders can navigate this dynamic environment with greater confidence. Remember, ongoing education and adaptability are key to long-term success in Forex trading.